Classification - HELOC Credit Risk

Predicting credit risk for Home Equity Line of Credit applications using the FICO HELOC dataset.

Dataset Source:

FICO HELOC Dataset

Problem Type: Classification

Target Variable: RiskPerformance - Whether applicant will pay as negotiated

(Good/Bad) Use Case: Credit risk assessment for financial institutions to identify

borrowers at risk of defaulting

Package Imports

Install and import relevant packages

!pip install xplainable

!pip install xplainable-client

import pandas as pd

from sklearn.model_selection import train_test_split

import requests

import json

import xplainable as xp

from xplainable.core.models import XClassifier

from xplainable.core.optimisation.bayesian import XParamOptimiser

from xplainable.preprocessing.pipeline import XPipeline

from xplainable.preprocessing import transformers as xtf

# New refactored client import

from xplainable_client.client.client import XplainableClient

from xplainable_client.client.base import XplainableAPIError

Data Loading and Exploration

Load the HELOC dataset and explore its structure

# Load dataset

data = pd.read_csv('https://xplainable-public-storage.syd1.digitaloceanspaces.com/example_data/heloc_dataset.csv')

# Display basic information

print(f"Dataset shape: {data.shape}")

print(f"Target distribution:\n{data['RiskPerformance'].value_counts()}")

data.head()

Where the defition of each of the fields are below:

| Variable Names | Description |

|---|---|

| RiskPerformance | Paid as negotiated flag (12-36 Months). String of Good and Bad |

| ExternalRiskEstimate | Consolidated version of risk markers |

| MSinceOldestTradeOpen | Months Since Oldest Trade Open |

| MSinceMostRecentTradeOpen | Months Since Most Recent Trade Open |

| AverageMInFile | Average Months in File |

| NumSatisfactoryTrades | Number of Satisfactory Trades |

| NumTrades60Ever2DerogPubRec | Number of Trades 60+ Ever |

| NumTrades90Ever2DerogPubRec | Number of Trades 90+ Ever |

| PercentTradesNeverDelq | Percent of Trades Never Delinquent |

| MSinceMostRecentDelq | Months Since Most Recent Delinquency |

| MaxDelq2PublicRecLast12M | Max Delinquency/Public Records in the Last 12 Months. See tab 'MaxDelq' for each category |

| MaxDelqEver | Max Delinquency Ever. See tab 'MaxDelq' for each category |

| NumTotalTrades | Number of Total Trades (total number of credit accounts) |

| NumTradesOpeninLast12M | Number of Trades Open in Last 12 Months |

| PercentInstallTrades | Percent of Installment Trades |

| MSinceMostRecentInqexcl7days | Months Since Most Recent Inquiry excluding the last 7 days |

| NumInqLast6M | Number of Inquiries in the Last 6 Months |

| NumInqLast6Mexcl7days | Number of Inquiries in the Last 6 Months excluding the last 7 days. Excluding the last 7 days removes inquiries that are likely due to price comparison shopping. |

| NetFractionRevolvingBurden | This is the revolving balance divided by the credit limit |

| NetFractionInstallBurden | This is the installment balance divided by the original loan amount |

| NumRevolvingTradesWBalance | Number of Revolving Trades with Balance |

| NumInstallTradesWBalance | Number of Installment Trades with Balance |

| NumBank2NatlTradesWHighUtilization | Number of Bank/National Trades with high utilization ratio |

| PercentTradesWBalance | Percent of Trades with Balance |

1. Data Preprocessing

Prepare features and target variable

y = data['RiskPerformance']

x = data.drop('RiskPerformance',axis=1)

Create Train/Test Split

X, y = data.drop(columns=['RiskPerformance']), data['RiskPerformance']

X_train, X_test, y_train, y_test = train_test_split(

X, y, test_size=0.2, random_state=42, stratify=y

)

2. Model Optimization

The XParamOptimiser fine-tunes the hyperparameters of our model to achieve optimal performance.

opt = XParamOptimiser(metric='f1-score', n_trials=300, n_folds=2, early_stopping=150)

params = opt.optimise(X_train, y_train)

3. Model Training

Train the XClassifier with optimized parameters.

model = XClassifier(**params)

model.fit(X_train, y_train)

4. Model Interpretability and Explainability

Generate insights into the model's decision-making process and understand feature importance.

model.explain()

Analysing Feature Importances and Contributions

Click on the bars to see the importances and contributions of each variable.

Feature Importances

The relative significance of each feature (or input variable) in making predictions. It indicates how much each feature contributes to the model’s predictions, with higher values implying greater influence.

Feature Significance

The effect of each feature on individual predictions. For instance, in this model, feature contributions would show how each feature (like the net fraction of trades revolving burden) affects the predicted risk estimate for a particular applicant.

5. Model Persistence

Save the model to Xplainable Cloud for collaboration and deployment.

In this step, we first create a unique identifier for our HELOC risk prediction model using client.create_model_id. This identifier, referred to as model_id, represents the newly created model that predicts the likelihood of applicants defaulting on their line of credit. After creating this model identifier, we generate a specific version of the model using client.create_model_version, passing in our training data. The resulting version_id represents this particular iteration of our model, allowing us to track and manage different versions systematically.

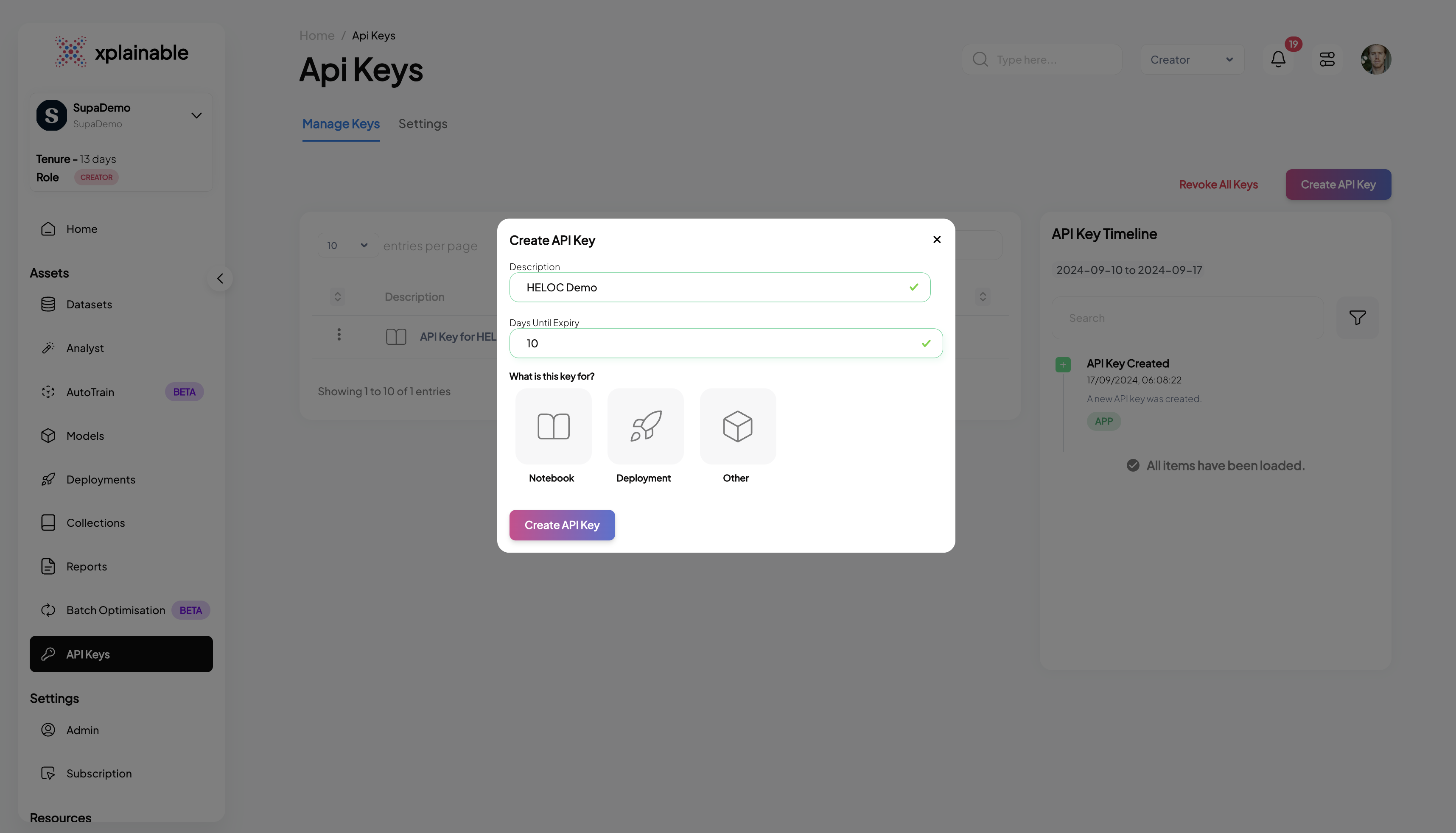

Xplainable Cloud Setup

# Initialize Xplainable Cloud client using new refactored client

client = XplainableClient(

api_key="", # Add your API key from https://platform.xplainable.io/

hostname="https://platform.xplainable.io" # Optional, defaults to production

)

# Create a model using the new client's models service

try:

model_id, version_id = client.models.create_model(

model=model,

model_name="HELOC Credit Risk Model",

model_description="Predicting applicant credit risk for HELOC applications",

x=X_train,

y=y_train

)

print(f"Model created successfully!")

print(f"Model ID: {model_id}")

print(f"Version ID: {version_id}")

except XplainableAPIError as e:

print(f"Error creating model: {e.message}")

model_id, version_id = None, None

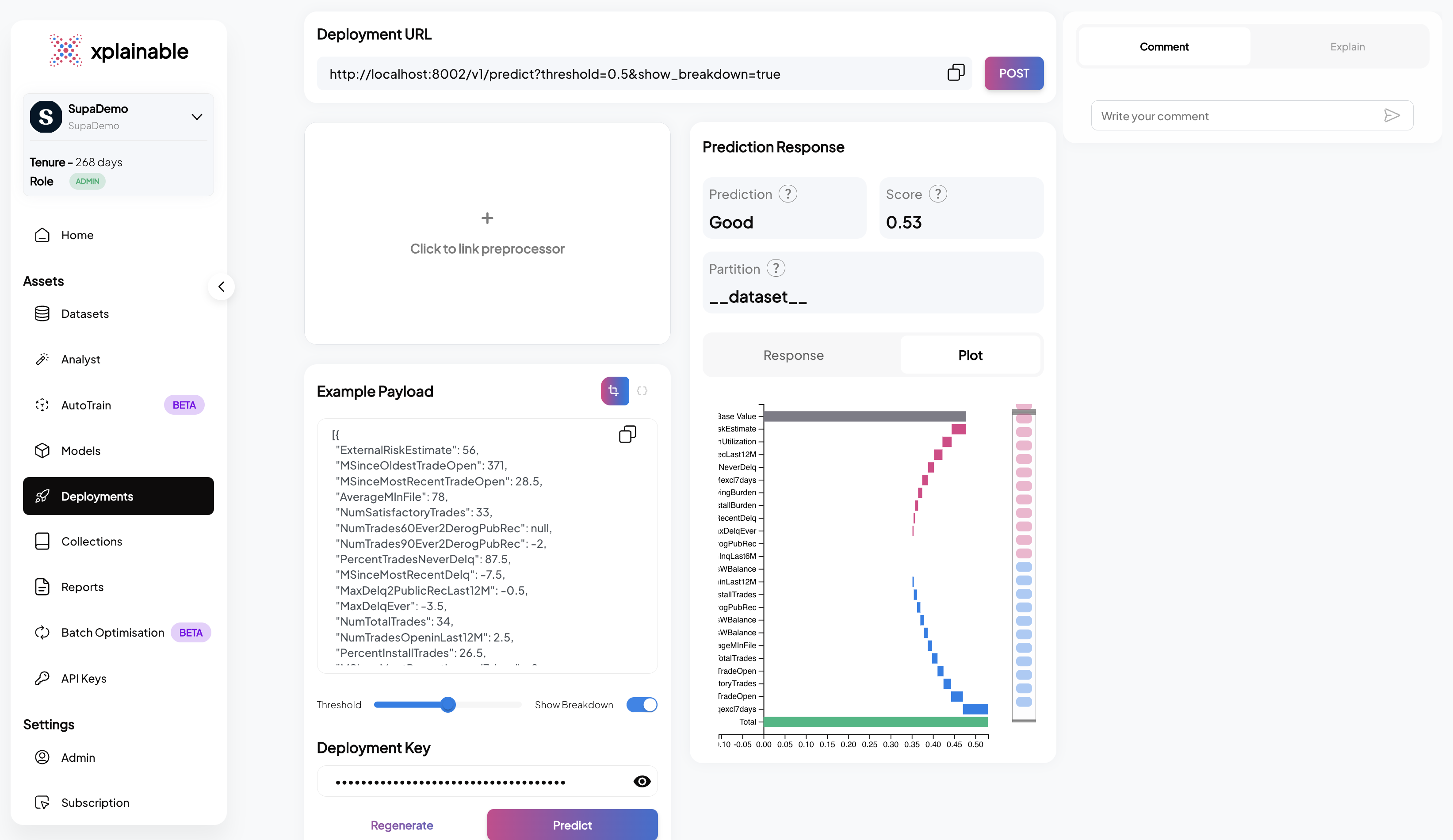

6. Model Deployment

Deploy the model for real-time predictions.

The code block illustrates the deployment of our credit risk prediction model using the

client.deployments.deploy function. The deployment process involves specifying the

unique model_version_id that we obtained in the previous steps. This step effectively

activates the model's endpoint, allowing it to receive and process prediction requests.

The deployment response confirms the successful deployment with a deployment_id and

other relevant information.

model_id

print(f"Model ID: {model_id}")

print(f"Version ID: {version_id}")

# Deploy the model using the new client's deployments service

try:

deployment_response = client.deployments.deploy(model_version_id=version_id)

deployment_id = deployment_response.deployment_id

print(f"Model deployed successfully!")

print(f"Deployment ID: {deployment_id}")

except XplainableAPIError as e:

print(f"Error deploying model: {e.message}")

deployment_id = None

print(f"Deployment ID: {deployment_id}")

- Activating the Deployment: The model deployment is activated using

client.activate_deployment, which changes the deployment status to active, allowing it to accept prediction requests.

# Activate deployment using the new client

try:

client.deployments.activate_deployment(deployment_id)

print("Deployment activated successfully!")

except XplainableAPIError as e:

print(f"Error activating deployment: {e.message}")

# Generate deployment key using the new client

try:

deploy_key = client.deployments.generate_deploy_key(

deployment_id=deployment_id,

description='HELOC Deploy Key',

days_until_expiry=7

)

print(f"Deployment key generated: {str(deploy_key)[:20]}...")

except XplainableAPIError as e:

print(f"Error generating deploy key: {e.message}")

deploy_key = None

#Set the option to highlight multiple ways of creating data

option = 2

if option == 1:

# Generate example payload using the new client

try:

body = client.deployments.generate_example_deployment_payload(deployment_id)

except:

body = json.loads(data.drop(columns=["RiskPerformance"]).sample(1).to_json(orient="records"))

else:

body = json.loads(data.drop(columns=["RiskPerformance"]).sample(1).to_json(orient="records"))

- Making a Prediction Request: A POST request is made to the model's prediction endpoint with the example payload. The model processes the input data and returns a prediction response, which includes the predicted class (e.g., 'No' for no churn) and the prediction probabilities for each class.

# Make prediction request

if deploy_key:

response = requests.post(

url="https://inference.xplainable.io/v1/predict",

headers={'api_key': str(deploy_key)}, # Convert deploy_key to string

json=body

)

value = response.json()

print("Prediction response:")

print(value)

else:

print("Deploy key not available, skipping prediction test")